📉 GDP Declines While Inflation Holds Firm

Thursday’s GDP report confirmed that the economy is decelerating. GDP came in at 2.3%, a notable drop from the prior reading of 3.1%. This signals that economic expansion is losing steam, which is a concern given the backdrop of high interest rates and uncertainty around fiscal policies.

However, the GDP Price Index—which reflects inflation within the economy—came in at 2.4%, above the expected 2.2% and the previous 1.9%. This means inflation is still lingering, even as growth slows.

💰 Inflation: Mixed Signals, but Still Stubborn

While Thursday’s GDP report suggested inflation was running slightly hot, Friday’s Core PCE Price Index MoM came in at 0.3%, matching expectations.

This data suggests inflation isn’t accelerating dramatically, but components within it remain sticky. The real concern is that inflation is staying above target while growth weakens, a setup that leans toward stagflation—a term lightly mentioned in recent Fed commentary.

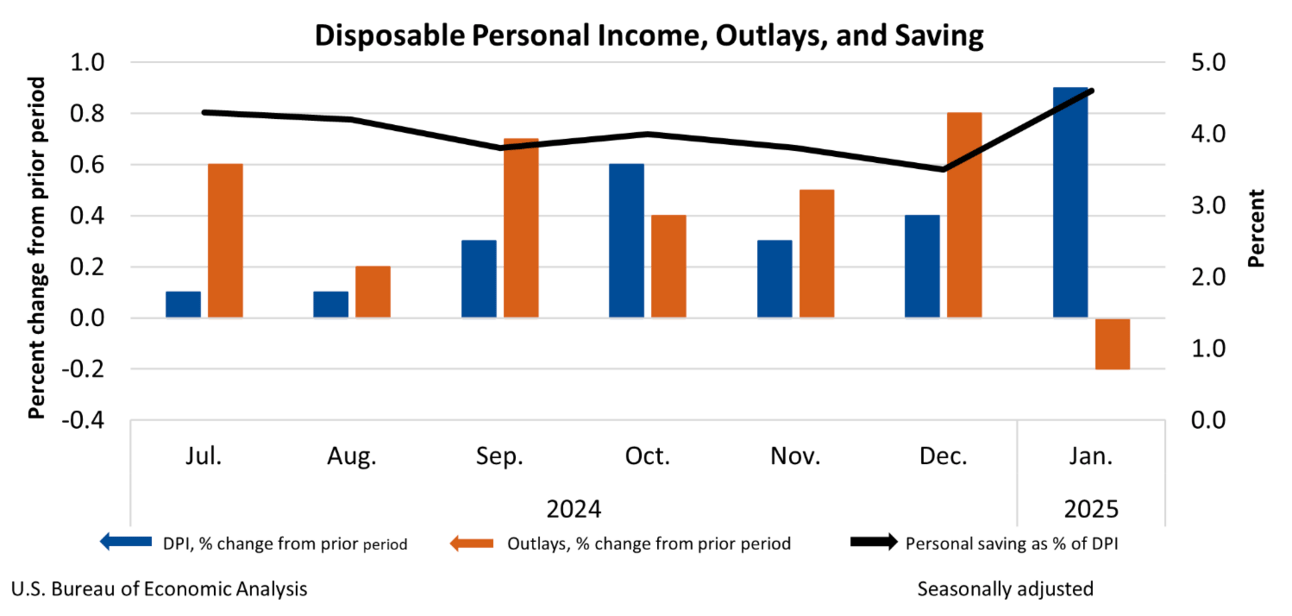

The most concerning data point? Personal Spending. It came in at -0.2%, down sharply from +0.8% last month. This suggests that consumers are pulling back on spending, which could further pressure growth in the months ahead.

💼 Jobless Claims: Labor Market Still Resilient

Initial Jobless Claims came in at 210K, right in line with expectations. Continuing Claims edged slightly higher, signaling that while the labor market remains strong, some softness is emerging.

Despite slowing growth, the low level of jobless claims suggests no immediate recession risk. However, if economic conditions deteriorate, we could see weaker hiring and rising unemployment in the months ahead.

Key takeaway: The labor market remains solid, but if jobless claims start trending higher in Q2, recession concerns will grow.

🖥️ Nvidia Earnings: Strong Numbers, Weak Market Reaction

Wednesday’s biggest event was Nvidia’s earnings release. The company reported record revenue for both the quarter and the year. Despite projecting continued growth into 2026, Nvidia acknowledged that growth is slowing.

Immediately after the release, Nvidia shares saw a brief bounce, but by Thursday’s session, the stock had pulled back to new local lows. Instead of boosting the broader market, Big Tech and the major indices sold off further.

This highlights just how fragile sentiment is right now. Even strong earnings aren’t enough to drive sustained risk-on behavior, as investors remain jittery over macro uncertainty.

📉 Risk-Off Trade Strengthens: Traditional Markets Seek Safety

This past week saw a clear flight to safety in TradFi markets, with investors rotating into defensive assets.

The key indicators of risk-off sentiment:

✅ DXY up (Investors seeking safety in the US Dollar)

✅ US10Y Yield down (Bonds bid as investors hedge against uncertainty)

❌ S&P 500 (SPX) and Nasdaq (NDX) down (Risk assets under pressure)

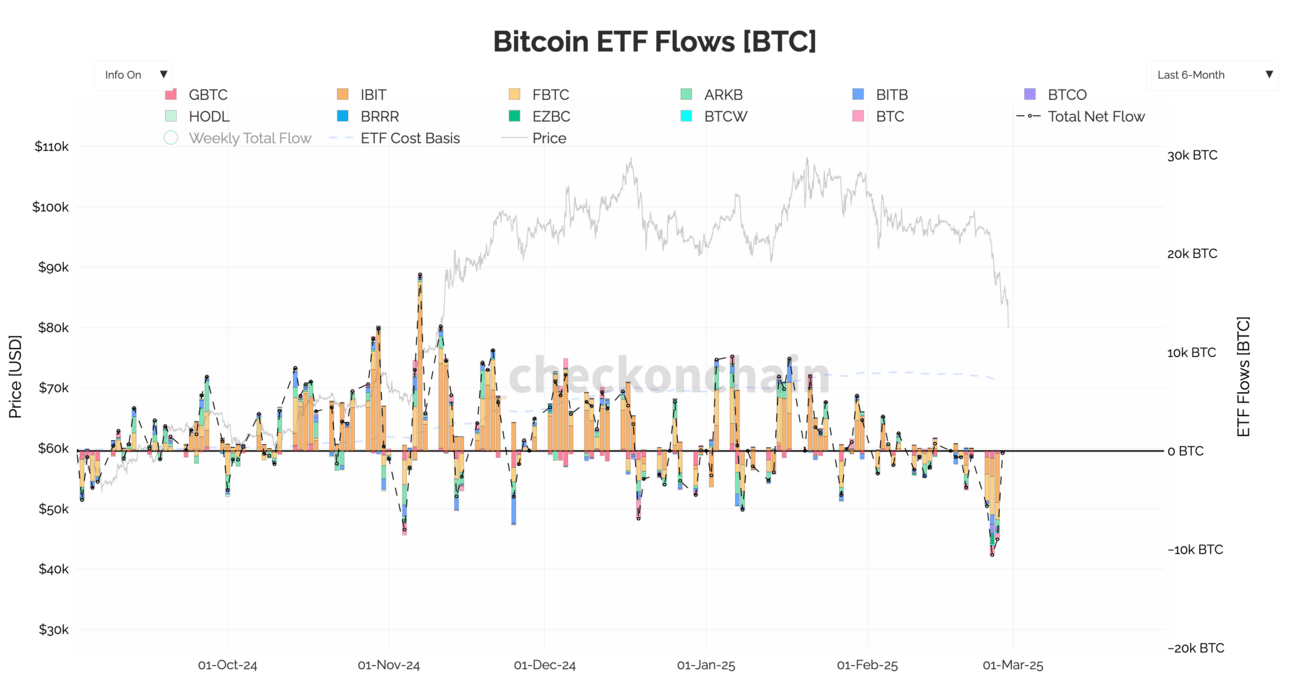

❌ BTC down ~17% since Monday (Crypto following broader risk-off move)

📉 Crypto Outlook: Short-Term Relief Possible, But Downside Remains

Short term, BTC and majors are extremely oversold, so a small relief rally is possible in the coming days. However, in the next few months, the bias remains to the downside due to:

• Uncertainty around Trump’s tariffs & policies, keeping companies cautious.

• Slowing growth + sticky inflation = stagflation risks.

• Lack of bullish catalysts means risk assets will struggle.

• Alts are bleeding, and that trend could continue unless macro conditions shift.

BTC large outflows this past week:

🛑 When Will It Be Time to Buy?

Even with prices dropping, it’s not yet time to buy aggressively. The key issue isn’t just price—it’s the macro timeline.

Instead of buying blindly, it makes sense to wait for clarity. When macro uncertainty fades, policies become clearer, and markets stabilize, that’s when risk exposure can be increased.

For now, preserving capital and waiting for better conditions is the best move.

TL;DR - Key Takeaways

• Growth is slowing, but inflation remains sticky, hinting at stagflation risks.

• Jobless claims remain low, signaling no immediate recession concerns.

• Nvidia’s strong earnings didn’t lift the market, highlighting fragile sentiment.

• Markets are in full risk-off mode: DXY up, Bonds bid, Stocks & Crypto down.

• BTC is oversold—short-term bounce possible, but broader trend still favors downside.

• Not looking to buy yet—waiting for macro clarity before adding risk.